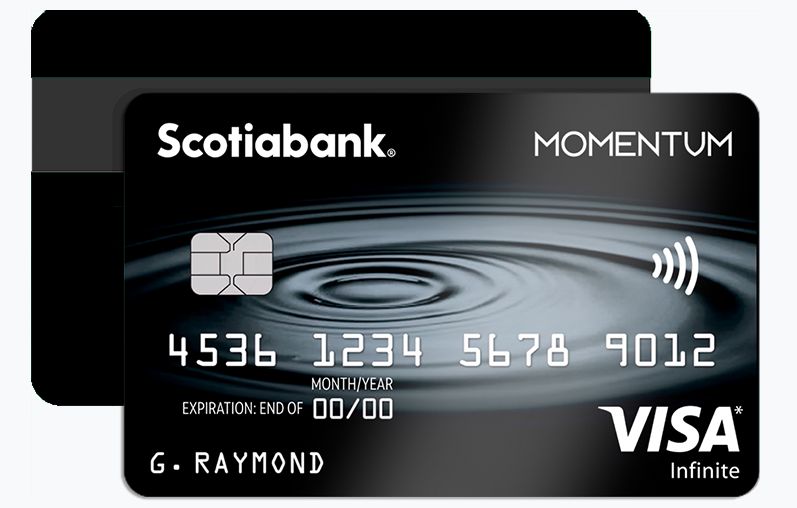

The Scotia Momentum Visa already stands out for its dependable cash-back structure, but many potential applicants don’t realize how much untapped value lies beneath its standard feature list. Beyond the marketed perks, this card includes subtle mechanisms and behind-the-scenes policies that can significantly enhance your approval odds, reward efficiency, and long-term credit performance.

More Advantages of the Scotia Momentum Visa

1. Priority Billing Recognition for Government and Semi-Government Payments

A lesser-known advantage is that the Scotia Momentum Visa system recognizes and processes certain government-adjacent recurring charges—such as municipal services or regulated utilities—faster than many competitor cards. This can provide smoother cash-flow timing for cardholders who rely on autopay for multiple public services.

2. Adaptive Limit Calibration During the First 90 Days

Scotiabank’s internal risk model often reviews new Scotia Momentum Visa accounts at least twice during your first three months. If your usage pattern appears stable—meaning on-time payments, moderate utilization, and consistent spending types—the system may automatically recalibrate your internal limit score. This isn’t a publicized “automatic credit limit increase,” but an internal adjustment that can influence future approvals for limit boosts across other Scotiabank products.

3. Expenditure Pattern Tracking for Hidden Reward Optimization

Although the cash-back rates are fixed, the card uses a silent categorization audit every billing cycle. For users who frequently switch spending categories (e.g., alternating between groceries and gas depending on season), the algorithm learns to detect spending rhythms. This can minimize miscategorization errors and ensure more transactions qualify for the highest available reward tier.

4. Subtle Fraud-Prevention Buffer That Reduces Authorization Declines

The Momentum Visa includes a behavioral risk buffer, meaning the system becomes more tolerant of atypical purchases as it learns your patterns. Travelers or online gig workers benefit from fewer false declines on unusual transaction locations or amounts.

5. Multi-Device Login Consistency Boost for Mobile Banking

If you switch between devices often—tablet, phone, desktop—the card’s mobile integration maintains your reward projection data consistently across devices. This reduces latency in the cash-back tracker, giving you real-time accuracy that competitive cards often lack.

Eligibility Criteria: What You Need Before Applying

Applying for the Scotia Momentum Visa is more straightforward than many users expect, but understanding the nuanced requirements dramatically improves your chances of approval. Here are the practical and lesser-known prerequisites:

1. Minimum Income Threshold (Not Always Enforced the Same Way)

Although Scotiabank lists a recommended income range, internal approval models may weigh consistent banking behavior more than raw income. Applicants with stable deposit activity—even at modest amounts—often perform better than those with higher but sporadic income.

2. Credit Score Sweet Spot

A typical approval range sits around the “good” category, but the bank also reviews credit velocity—how many new accounts you’ve opened in the last six months. Even with a strong score, too many recent credit inquiries may slow approval.

3. Proof of Residency and Established Address History

Applicants with at least one year at the same address tend to receive higher internal trust scores. If you’ve recently moved, adding a secondary proof of address can sometimes help during manual review.

4. Active Canadian Bank Account (Any Institution)

While not mandatory, having an active checking account with a predictable transaction pattern—regardless of institution—greatly reinforces your financial stability signal.

FAQ: Scotia Momentum Visa – Most Common Applicant Questions

1. Does Scotiabank perform a hard credit check when I apply?

Yes. All Scotia Momentum Visa applications require a hard inquiry, which is standard for credit applications in Canada.

2. Do newcomers or temporary residents qualify?

Some do. Scotiabank has specific internal programs that evaluate newcomers differently. If you have proof of income and stability, you may still be eligible.

3. How fast can I receive the card after approval?

Physical cards typically arrive in under 10 business days, but digital wallet provisioning may be available within 24–48 hours depending on your profile.

4. Can I request a higher limit during the initial application?

Limit assessments happen automatically. However, strong deposit history—especially if you bank with Scotiabank—can significantly influence your starting limit.

5. When do cash-back rewards post?

Rewards accumulate in real time and are applied during the annual payout cycle. However, usage data is updated daily inside the app.

How to Apply for the Scotia Momentum Visa: Simple Step-by-Step Guide

1. Prepare Your Documentation

Gather your income proof, government ID, and residential address documentation. You’ll also need details about your employer or income source.

2. Complete the Application Form

Provide accurate personal and financial information. Avoid leaving optional fields blank, as this can delay processing or result in a manual review.

3. Allow the System to Run a Credit Check

The bank performs an instant credit assessment. Most applicants receive a decision in under 60 seconds.

4. Review and Accept the Terms

If approved, you’ll be prompted to accept the cardholder agreement. This secures your limit and creates your active account.

5. Set Up Digital Access

Once your application is finalized, activate your card within Scotiabank’s mobile app to begin tracking rewards, spending categories, and subscription recognition.

Tips to Increase Your Chances of Scotia Momentum Visa Approval

1. Maintain a “Pre-Application Spending Window”

For 30–45 days before applying, avoid applying for or opening new credit products. This stabilizes your credit velocity score and improves your internal risk estimate.

2. Keep Utilization Below 35% Before the Credit Check

Even if you pay your balances in full each month, ensure your reported balances are moderate at the time the card pulls your credit.

3. Establish Recurring Deposits (Even Small Ones)

If you already bank with Scotiabank, setting up recurring small deposits—even as low as $25 weekly—signals banking engagement and reduces perceived risk.

4. Avoid Rapid Address Changes

Keep your address consistent across all documents. Address mismatches are a frequent cause of application delays.

5. Show Income Stability Over Income Amount

Choose the income source that reflects continuity over the highest number. A consistent job or long-term contract weighs more heavily than a temporary income spike.

CIBC Costco Mastercard – Complete Guide to Requirements, Benefits & Application Tips <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Unlock Higher Cashback, Faster Approval, and Smarter Savings</p>

CIBC Costco Mastercard – Complete Guide to Requirements, Benefits & Application Tips <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Unlock Higher Cashback, Faster Approval, and Smarter Savings</p>  Harley Davidson Credit Card – Extra Benefits, Requirements & Fast Application Guide <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>More advantages, hidden qualifiers, expert tips and commercial-insight strategies to help you secure your card today</p>

Harley Davidson Credit Card – Extra Benefits, Requirements & Fast Application Guide <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>More advantages, hidden qualifiers, expert tips and commercial-insight strategies to help you secure your card today</p>  Conexus Cash Back Credit Card: Your Complete Guide to Maximizing Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Deep Insights, Hidden Benefits & Practical Steps to Apply Successfully</p>

Conexus Cash Back Credit Card: Your Complete Guide to Maximizing Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Deep Insights, Hidden Benefits & Practical Steps to Apply Successfully</p>