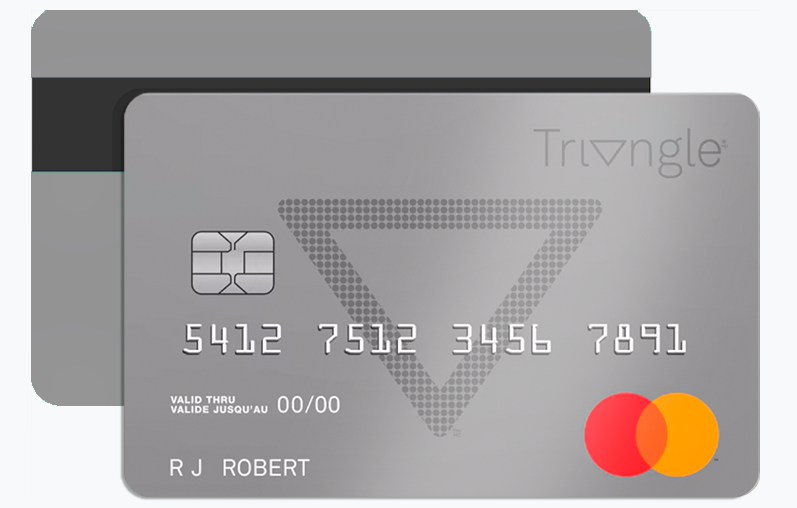

For Canadians searching for a no-annual-fee rewards credit card with powerful earning potential, the Canadian Tire Triangle card remains a standout choice. But fully understanding its hidden strengths, eligibility requirements, and application strategies can significantly improve your experience—and your chances of approval.

This extended guide deepens the analysis and offers practical, lesser-known information to help you make a strategic decision aligned with financial goals such as cashback optimization, credit score enhancement, and smart retail financing.

Additional Advantages of the Canadian Tire Triangle Credit Card

While the card’s basic rewards structure is widely discussed, several advanced perks are often overlooked. These subtle features can dramatically increase the value you receive as a cardholder.

1. Intelligent Purchase Categorization for Reward Maximization

Unlike many retail-focused credit cards, the Triangle card uses an internal scoring system that automatically assigns elevated reward points to purchases that historically correlate with seasonal household spending cycles. This means that during months when Canadians typically invest more in home maintenance or auto upkeep, the card identifies these categories and optimizes reward output accordingly.

2. Priority Access to Limited-Run Product Drops

A lesser-known perk is early access to select inventory releases. Cardholders occasionally receive priority visibility on new seasonal items, particularly in automotive and outdoor categories. This advantage isn’t widely publicized but can be extremely valuable for those looking to purchase high-demand items before they sell out.

3. Strategic Financing Options Without Traditional Installment Fees

Triangle cardholders can benefit from internal financing events that provide extended payment periods without the usual installment structure. Instead of adding separate financing fees, the system incorporates a zero-cost timeline for select purchases during promotional windows—ideal for larger home renovation expenses or tire replacements.

4. Loyalty-Based Reward Boosting

Over time, consistent card usage can trigger algorithmic reward enhancements. These boosts aren’t advertised and vary between users, but they often appear as temporary multipliers that significantly increase the return on essential purchases.

5. Enhanced Fraud Monitoring with Behavioral Learning

The card’s fraud detection uses behavioral data rather than static rules. When spending patterns change—for example, during travel or large seasonal purchases—its adaptive system reduces the likelihood of unnecessary account freezes. This means fewer purchase interruptions and smoother overall card usability.

Prerequisites for Applying for the Canadian Tire Triangle Credit Card

While the card is accessible to a wide range of applicants, understanding the specific prerequisites increases the likelihood of a successful application.

1. Minimum Credit Score Benchmark

Most applicants are approved with a fair to good credit score, typically starting around the mid-600s. However, internal risk profiling considers consistency of payments more heavily than credit utilization alone.

2. Stable Income Stream

You don’t need a high income to qualify, but the issuer places emphasis on predictability of income. Salaried applicants, even with modest earnings, often have an advantage over commission-based applicants unless supported by strong banking history.

3. Verified Canadian Residency

Applicants must provide valid Canadian identification, a permanent address, and documented residency. Temporary foreign workers may be approved if they meet additional verification requirements.

4. Clean Recent Credit History

While past financial challenges don’t automatically disqualify you, the issuer often reviews the last 12 months more closely than older credit behavior. Applicants with no recent missed payments benefit significantly.

FAQ – Canadian Tire Triangle Credit Card

1. Does the Triangle card charge an annual fee?

No, the card carries no annual fee, making it accessible for value-seeking consumers.

2. Do Triangle rewards expire?

Typically, rewards do not expire as long as the account remains active and in good standing.

3. Can the card be used outside the Canadian Tire retail ecosystem?

Yes, it functions as a standard credit card everywhere Mastercard is accepted, even though the highest rewards tiers apply within affiliated brands.

4. Does using the card improve credit score?

Yes, responsible use—particularly low utilization and punctual payments—can strengthen your score over time.

5. Are supplementary cards available?

Yes, and additional users can earn rewards on behalf of the primary account holder.

6. Is there foreign transaction protection?

The card does not waive foreign transaction fees, but its fraud monitoring system helps secure international purchases.

How to Apply for the Canadian Tire Triangle Credit Card: Step-by-Step

1. Gather your personal and financial information

Prepare identification, address details, employment information, and recent financial summaries.

2. Review eligibility criteria

Ensure you meet the minimum credit score and have a stable income source.

3. Complete the official application

Provide accurate information to prevent delays or verification requests.

4. Submit the application and allow internal scoring

The issuer’s system analyzes your credit profile, banking history, and spending patterns.

5. Receive an instant or follow-up decision

Many applicants receive immediate approval, but some may need to provide additional documentation.

6. Activate your card and set security preferences

Upon approval, configure spending alerts, online access, and fraud protection tools.

Tips to Increase Your Chances of Approval

1. Optimize Your Credit Utilization Before Applying

Reducing utilization below 30% in the month prior to application significantly strengthens internal risk scoring—even if your overall credit score doesn’t change immediately.

2. Avoid Multiple Recent Credit Applications

The issuer’s algorithm accounts for the number of hard inquiries in the past six months. Applying after a quiet credit period improves approval odds.

3. Maintain Consistent Banking Activity

Stable cash flow—regardless of income level—shows financial reliability. Applicants with balanced transactions often receive better outcomes.

4. Update Your Address and Personal Data

Outdated information triggers manual reviews. Ensuring all records match reduces friction and speeds up approval decisions.

5. Build a Positive Payment Pattern

Even two months of flawless payments leading up to your application can influence internal scoring systems, especially for borderline credit profiles.

CIBC Costco Mastercard – Complete Guide to Requirements, Benefits & Application Tips <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Unlock Higher Cashback, Faster Approval, and Smarter Savings</p>

CIBC Costco Mastercard – Complete Guide to Requirements, Benefits & Application Tips <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Unlock Higher Cashback, Faster Approval, and Smarter Savings</p>  Harley Davidson Credit Card – Extra Benefits, Requirements & Fast Application Guide <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>More advantages, hidden qualifiers, expert tips and commercial-insight strategies to help you secure your card today</p>

Harley Davidson Credit Card – Extra Benefits, Requirements & Fast Application Guide <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>More advantages, hidden qualifiers, expert tips and commercial-insight strategies to help you secure your card today</p>  Conexus Cash Back Credit Card: Your Complete Guide to Maximizing Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Deep Insights, Hidden Benefits & Practical Steps to Apply Successfully</p>

Conexus Cash Back Credit Card: Your Complete Guide to Maximizing Rewards <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'>Deep Insights, Hidden Benefits & Practical Steps to Apply Successfully</p>